What a Relief! Congress Acts Against Surprise Medical Bills

If you have ever been caught off-guard by a large medical bill, a long-running practice known as balance billing might be the reason. A balance bill — which is the difference between an out-of-network provider's normal charges for a service and a lower rate reimbursed by insurance — can amount to thousands of dollars.

Many consumers are already aware that it usually costs less to seek care from in-network health providers, but that's not always possible in an emergency. Complicating matters, some hospitals and urgent-care facilities rely on physicians, ambulances, and laboratories that are not in the same network. In fact, a recent survey found that 18% of emergency room visits resulted in at least one surprise bill.1

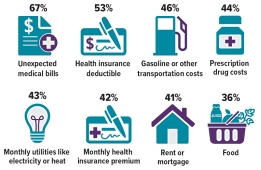

Who's Afraid of High Health-Care Costs? Most People

Percent of surveyed adults who say they are worried about being able to afford the following expenses

Source: Kaiser Family Foundation and JAMA, 2020

Coming Soon: Comprehensive Protection

The No Surprises Act was included in the omnibus spending bill enacted by the federal government at the end of 2020. The new rules will help ensure that consumers do not receive unexpected bills from out-of-network providers they didn't choose or had no control over. Once the new law takes effect in 2022, patients will not receive balance bills for emergency care, or for nonemergency care at in-network hospitals, when they are unknowingly treated by out-of-network providers. (A few states already have laws that prevent balance billing unless the patient agrees to costlier out-of-network care ahead of time.)

Patients will be responsible only for the deductibles and copayment amounts that they would owe under the in-network terms of their insurance plans. Instead of charging patients, health providers will negotiate a fair price with insurers (and settle disputes with arbitration). This change applies to doctors, hospitals, and air ambulances — but not ground ambulances.

Consent to Pay More

Some patients purposely seek care from out-of-network health providers, such as a trusted family physician or a highly regarded specialist, when they believe the quality of care is worth the extra cost. In these nonemergency situations, physicians can still balance bill their patients. However, a good-faith cost estimate must be provided, and a consent form must be signed by the patient, at least 72 hours before treatment. Some types of providers are barred from seeking consent to balance bill for their services, including anesthesiologists, radiologists, pathologists, neonatologists, assistant surgeons, and laboratories.

Big Bills Will Keep Coming

The fact that millions of consumers could be saved from surprise medical bills is something to celebrate. Still, many people may struggle to cover their out-of-pocket health expenses, in some cases because they are uninsured, or simply due to high plan deductibles or rising costs in general. Covered workers enrolled in family coverage contributed $5,588, on average, toward the cost of premiums in 2020, with deductibles ranging from $2,700 to more than $4,500, depending on the type of plan.2

When arranging nonemergency surgery or other costly treatment, you may want to take your time choosing a doctor and a facility because charges can vary widely. Don't hesitate to ask for detailed estimates and try to negotiate a better price.

If you receive a bill that is higher than expected, don't assume it is set in stone. Check hospital bills closely for errors, check billing codes, and dispute charges that you think insurance should cover. If all else fails, offer to settle your account at a discount.

1-2) Kaiser Family Foundation, 2020

This content is developed from third-party sources believed to be providing reliable information, however their accuracy and completeness cannot be guaranteed. This material has been prepared by a third party, Broadridge, that is unaffiliated with Townsend Asset Management Corp. and is provided for informational purposes only. The opinions herein may not represent the views of Townsend or its affiliates. Townsend has obtained permission to distribute this material. Townsend Asset Management Corp. is an independent investment adviser registered under the Investment Advisers Act of 1940, as amended. Registration does not imply a certain level of skill or training. More information about the firm can be found in its Form ADV Part 2, which is available upon request. TAM-21-78.